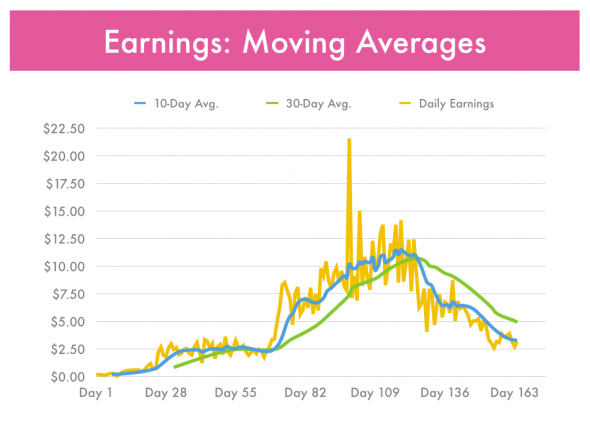

We’re going to look at a new chart today in order to understand moving averages.

This is a chart of daily earnings from all the Paid-To-Click sites in our PTC Portfolio. (Click the chart to zoom in and see it bigger.)

This is a chart of daily earnings from all the Paid-To-Click sites in our PTC Portfolio. (Click the chart to zoom in and see it bigger.)

The yellow line tracks daily earnings. It looks kinda like the seismic graph of an earthquake, don’t you think? Look at all those jaggy ups and downs. It’s hard to see any definite trend in the yellow line because it is impossible to predict what it will be from one day to the next.

The blue line is a 10-day moving average. It adds up the previous 10 days of earnings and divides by 10. So each day on the blue line is an average of the previous 10 days’ earnings. A moving average smooths out the ups and downs and is better able to indicate a trend and predict the future.

The green line is a 30-day moving average, and it’s an even smoother indicator of trends for the future.

ANALYZING THE TREND

The dominant trend you can see in all three of these plot lines is that earnings over the past 40 days have been declining. We’re still making money, but not as quickly as before.

There have been fewer and fewer ads to click on, and probably some referrals have become disheartened by this and stopped clicking. Here on Day 164, the 10-day moving average is $3.30 per day, and the 30-day moving average is $5.00 per day. That’s about half what our PTC portfolio was earning back on Day 98.

What do you think, will all three lines continue dropping? Down down down until they reach zero again?

Not likely.

Here’s the thing with moving averages — they tend to cross each other, back and forth through time. The blue line just barely crossed the green line back on about Day 60 and then swung higher; until about Day 120, when the blue line crossed the green again and continued to head lower.

Can you predict what the next number in this series will be?

60, 120, X ?

Just on the basis of these two crossing points, I am going to predict that the blue line will be crossing the green line on or about Day 180. That’s just a couple weeks from now.

Of course I could be completely wrong. There’s no rule that says the 10-day average must cross the 30-day average every 60 days. It could happen sooner, it could happen later, but I have no doubt it will happen. We’ll be visiting this chart again over the next several months to watch and see when the next several crossings actually happen. The more data points we have for those crossings, the easier it becomes to predict when the next one will happen.

DEALS DEALS DEALS

What might cause earnings to turn around, and start to head higher?

Well for one thing PTC owners are seeing reduced earnings revenue when there are fewer ads. So I would not be surprised if, during this current slow period, owners begin to present some irresistible offers that will cause advertisers to open their wallets and increase their spending once again. If you are doing your own advertising in the PTCs to build your Direct Referrals (I hope you are!) then you’ll want to keep your eyes open and take advantage of the deals when they appear.

In the meantime, be sure to utilize The Three-Legged Stool of traffic resources — including Traffic Exchanges and Safelists — to get as much free advertising as you can. And be building your downlines in those traffic resources by advertising your Downline Builders as well.

NAIDBUX IS BACK!

In a recent episode of “The Amazing Tale” I reported that NaidBux had vanished, and I thought it was dead. Turns out NaidBux was just having some trouble with their domain name registrar. The site is back now, and my previous earnings are still there, so NaidBux is back in the portfolio.

On the other hand, TheBux, seems to be having trouble paying. Their CashOut page has specific instructions on a day-by-day basis about when to request a cashout.

And after earning close to $20 at Clixor, I began wondering if it was too good to be true. I placed a cashout request there a few weeks ago but have not received payment yet. And several attempts to contact Support have gone unanswered. Not a good sign.

In order to be efficient with my time, I have stopped clicking at both TheBux and Clixor, until it becomes clear they are capable of paying cashout requests.

Great assessment as always Peter. Ahh, the ebb and flow of PTCs. Pretty cool huh? I have changed some tactics in order to accumulate more DRs which I am keeping Confidential. I shared a lot of my tactics in the past and now those I shared with are becoming self-appointed experts in the field LOL. I have been appointed a forum moderator at a pair of PTCs recently and am getting more of a pulse as to what is going on out there. Thanks as always for keeping it interesting! Let’s talk one day soon.

In the long run, getting Direct Referrals (DRs) is the best because you can keep them at no cost and they can add to your earnings for a long long time… however it really helps to be able to communicate with them, in order to keep them from getting disappointed when earnings make a downturn, so they know it’s normal, and will come back. So how to communicate with them? Get them on your email list before they join under you. I will be talking more details about this in an upcoming blog post tentatively titled “The Perfect Campaign.”

In the meantime, Adam, we’ll all try and figure out what you’re doing. ;)

LOL, sorry to be so cryptic, comes from my old Military Intelligence days :)

I agree with you as far as keeping in contact with the DRs, very important. I have been remiss as to building a “list”. I do have a huge list of email addresses but that is through one on one manual emails. You do a great job in that area obviously.